Helpful Bad Credit Features

Dedicated to helping with every aspect of having bad credit. From simple advice to qualifying for loans to get you on your feet. We are here to help you through the whole process from A to Z!

Best Credit Tips & Advice to Fix Credit Problems

Learn about the best ways to fix your credit. We have wonderful credit hacks, advice articles, and visual educational graphics to help make you a credit expert!

Low Interest Credit Cards to Help Build Credit

Learn how a credit card can help fix your credit. Also learn where to get the best credit cards for people with bad credit!

Loans for People with Bad Credit

Get a bad credit loan online through Bad Credit Lifeline. Learn everything about bad credit loans online, like what to do before and after getting a bad credit loan.

Where to Start for Repairing your Credit

If you have serious credit issues, we have a wonderful credit repair company that can help fix these issues. Go to the Credit Repair page to learn more!

No Credit to Good Credit With Helpful Credit Repair Information & Tools

We have helped thousands of people get the information they need to get back on top of their credit, and have helped many consumers to once again get a credit card, or qualify for a loan due to having good credit!

At Bad Credit lifeline we are dedicated to helping people repair bad credit problems. Our wonderful credit repair tools & knowledge will give you everything you need to be able to fix all credit & financial problems you might have! We know this because we have gone through this ourselves and have come out on top! We are confident we can help you do the same!

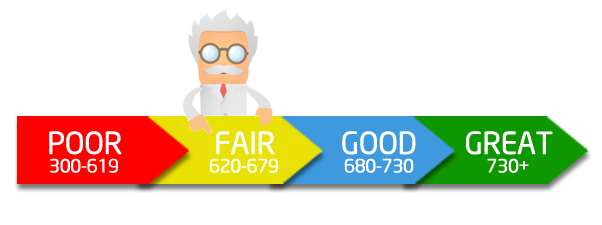

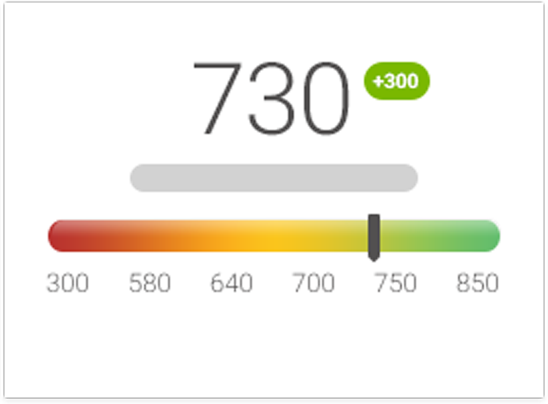

Visit our Credit 101 section for detailed information about Credit & Credit Scores

Basic Credit Information

Credit is all about trust

Can a creditor trust you with their money?

When they run your credit and there is either very limited information or no information at all, you are seen as having no credit. Having no credit is just a step up from having bad credit. Creditors don’t know if they should trust you because there is no available information letting them know they can.

Are you new to credit?

You will have high rates so it is better to be cautious when making purchases. No one wants to pay double for an item because of a 14.99% APR.

People who have bad credit or no credit will automatically get higher security deposits and higher interest rates. Building credit takes work and it takes time, here’s how:

- Apply for credit slowly. Every time you apply for credit, your hard credit report is run. This means that it will hurt your score each time it is done. The more often you do it within a certain time frame, the more it damages your score. Creditors will see you as aggressively seeking credit, which is not good. It is recommended to wait 6 months before trying again.

- Take care of it. You’re new which means it can go either way for you, good or bad. Be smart with your finances and treat it kindly. It is very easy to damage your score, but very difficult to bring it back up. Keep track of your finances and live within your means, only because you have credit doesn’t mean you should spend recklessly.

- Make your payments on time. No creditor wants to lend money to someone who is flaky with their payments. Always make the payments on time, even if all you can do is the minimum. Being a few days late will be reported to your credit history and it will drop your score. Make sure you are on time every month!

- Never spend more than you can manage. Interest will bury you quickly. Only because your credit card allows you to purchase something doesn’t mean you necessarily should.

- Keep away from your limit. In order to maintain a good credit score, you can only use 30% of your limit. For example, you have a credit limit of $1,000; it will look bad on your credit if you have an outstanding balance over $300.00.

- Monitor your credit. Always keep track of what you’re spending and how much you owe. Monitor your credit will help you in the long run. It is never too early to start. There are many companies that offer free credit reports. It does not hurt your credit if you ask for your report; it is seen as a soft hit.